Short-Term Rental Insurance

Three landlord exclusions you might not want for your short-term rental.

Maybe you got the entrepreneurial itch and are considering renting out your home or another property on AirBNB, VRBO, Furnished Finder, or another short-term rental service.

You'll be looking for a DP-3 Policy:

Most DP-3 dwelling landlord policies are endorsed to allow for short-term rental exposure. But they aren't written on a commercial form, which raises serious concerns as short-term rental properties are commercial business exposures.

Ultimately you would need to read the specific full policy for a complete comparison, but there are a few big themes worth noting.

The unique risks associated with running your property like a hotel.

Below are some limitations you will almost always see when comparing a Dwelling Fire Policy to a policy written specifically for short-term rentals.

Limitation: Vandalism, theft, and intentional acts from a tenant.

This is the biggest reason for a price reduction in covering your short-term rental with a Dwelling Fire Policy and is simply unknown to most consumers.

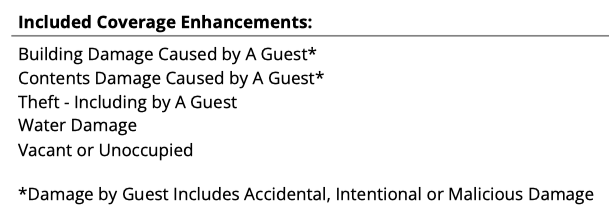

This short-term rental owner was denied a $13,000 claim because it excluded damage by guests in the fine print. Alternatively, this is a clip from a recent policy we wrote for an AirBNB property in Carlsbad:

Limitation: Liability Off-Premise

Dwelling Fire Liability Coverage does not extend off the premises. This is another huge limitation and reason for a price reduction.

A great example is a dog bite. If a renter snuck a dog to the vacation rental and it bit a bystander off the premises, not only does the renter get sued, but typically the owner of the property and the manager as well.

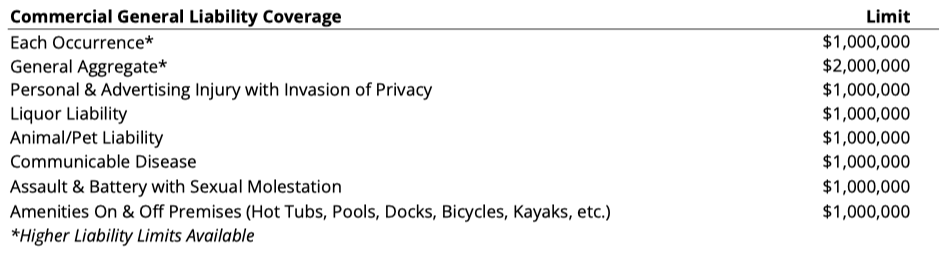

From that same policy, Animal/Pet Liability is covered along with Amenities On & Off Premises, and more.

Limitation: Loss of Rents vs Business Income

Dwelling Fire policies carry Loss of Rents which calculates loss of rent via the “fair market value” of every rental in your area including long-term, with a standard cap of 12 months. This is a big limitation and another reason for a price reduction.

Short-term rentals typically generate significantly more rental revenue, especially during the peak season. In the event of a total loss fire, it’s 18-24 months until the short-term rental property is fully operational to its condition before the fire. In this example above, you would choose your total limit to control the income cap.

More examples of coverages not typically found in DP-3 policies:

- Bed Bug & Flea Extermination Plus Business Revenue

- Squatters & Eviction Expenses Plus Business Revenue

- Assault or Sexual Acts Exclusion

- Ordinance and Law

- Liquor Liability

- Advertising Injury

- Invasion of Privacy

- Named Perils (Specifically Included) vs All-Risk (Not Excluded) for Building and Contents

Still unsure? Send this to your broker or agent.

If you’re still unsure that there are critical differences between a DP-3 and a proper insurance policy, I’d recommend sending the following to your broker/agent asking the below questions verbatim, and request that he or she respond to you in writing (or email) with an answer from their underwriter.

If they can answer ‘yes’ to the questions, save that email in the event of a claim.

- If I entrust my property/home to a paying Airbnb/VRBO short-term rental guest for 3 days, and that guest throws a party and vandalizes, damages, or steals my property, do I have property coverage to the limits of insurance?

- If I entrust my property/home to a paying Airbnb/VRBO short-term rental guest for 3 days, and that guest breaks into my neighbor’s dwelling unit and steals their property, does my liability extend?

- If I entrust my property/home to a paying Airbnb/VRBO short-term rental guest for 3 days, and that guest assaults another person who then sues me, do I have liability coverage?

- If I entrust my property/home to a paying Airbnb/VRBO short-term rental guest for 3 days, and that guest sues me for invasion of privacy, do I have liability coverage?

The premium may be more cost-effective on some policies, but the coverage may also be less than effective. Insurance is a highly regulated industry, so cheaper usually means less coverage is being offered.

If a liability claim is not covered (like above) it is you that has to pay for a lawyer to help find you not liable if named in a suit.