What auto insurance and used cars had in common (until 2022)

These charts are like my jokes – I'm probably going to explain them.

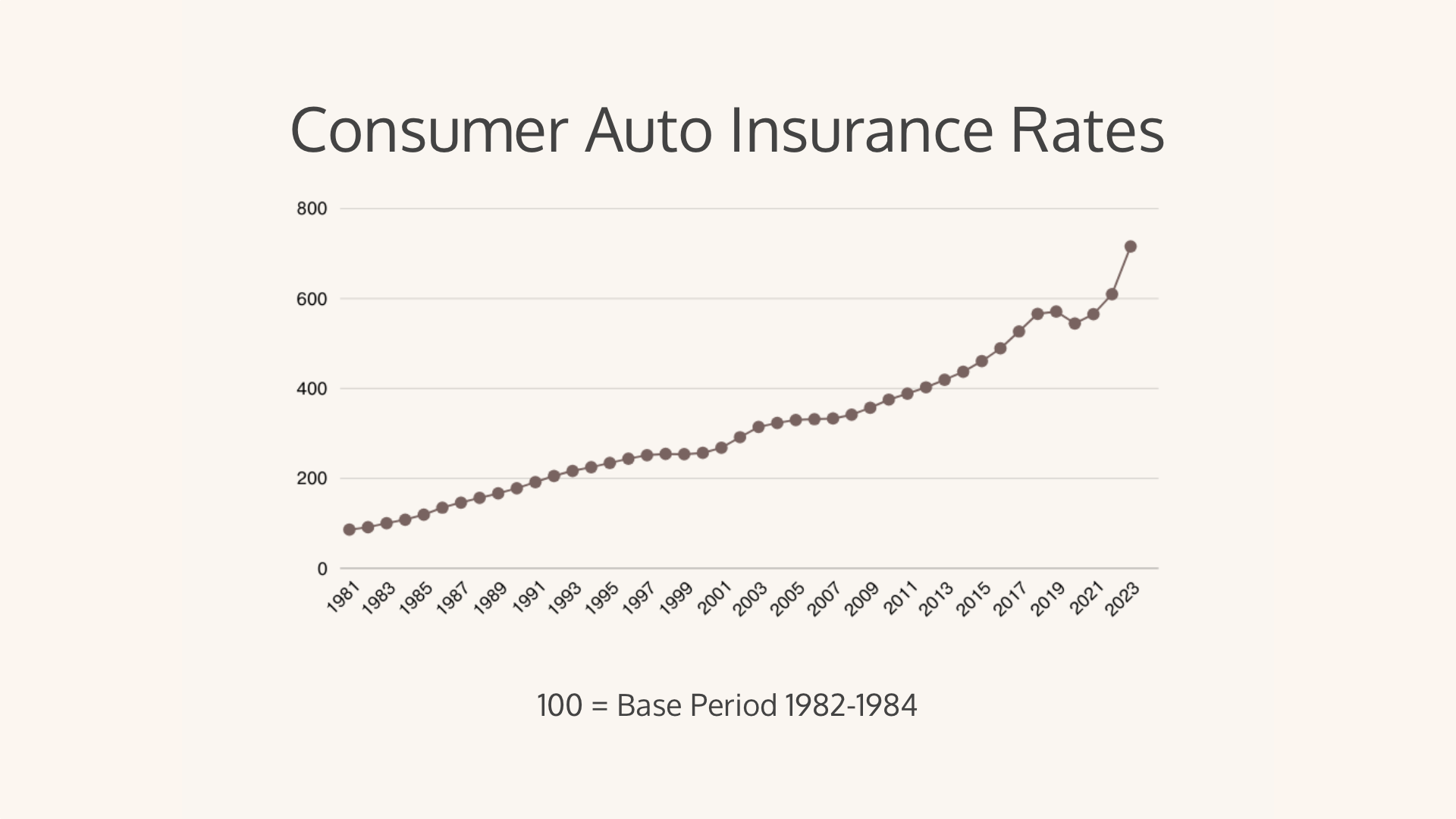

The latest Consumer Price Index report was released on March 12th, 2024, and I have smart friends who know I like anything mentioning insurance.

One of them texted me this snip from the report:

The index for all items less food and energy rose 3.8 percent over the past 12 months. The shelter index increased 5.7 percent over the last year, accounting for roughly two-thirds of the total 12-month increase in all items less food and energy index. Other indexes with notable increases over the last year include motor vehicle insurance (+20.6 percent), medical care (+1.4 percent), recreation(+2.1 percent), and personal care (+4.2 percent).

Core CPI increased a total of 83.5% YOY:

- 65.9% of the rise is due to an increase in the Rent of Shelter

- 17.6% of the rise is due to an increase in Motor Vehicle Insurance

What's Manheim got to do with it?

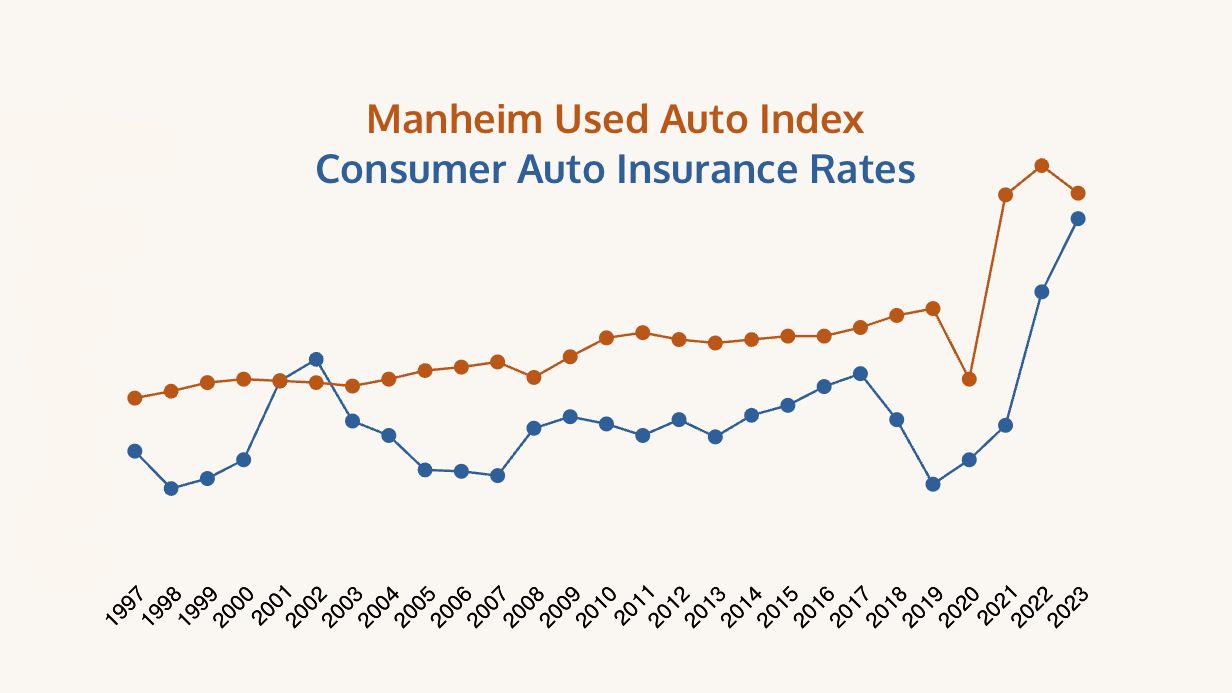

The Manheim Used Car Index and Motor Vehicle Insurance CPI usually coincide; however, they have started to separate since the start of this year. The used auto index is increasing, while motor vehicle insurance is still increasing.

Check this out:

Auto insurance rates generally align with the Manheim used auto index, rising and falling together. However, in 2022, used vehicle values peaked while auto insurance rates continued to rise.

And while it's a great disinflation signal to see the Manheim index dropping, why aren't auto rates following the trend sooner rather than later?

Manheim data is immediate, and CPI data lags ~30 days, so we will see how this looks in a few quarters. While I cannot predict the future by any means, I'd say auto insurance rates will start trending downward again within a few quarters.

Third-Party Litigation Funding (TPLF)

The Insurance Information Institute put out a report in July 2022 reviewing the practice of Litigation Funding.

What's happening here?

Third-party litigation funding (TPLF) is when a non-party funder agrees to pay for legal costs in exchange for a share of the case's proceeds. The funder is typically a private firm that receives funding from investors, such as a hedge fund or specialist funding company. The investor is paid out after a decision is made.

Why it matters:

$17 billion was spent funding TPLF cases in 2020, expected to increase to $30 billion by 2028.

Distracted Driving

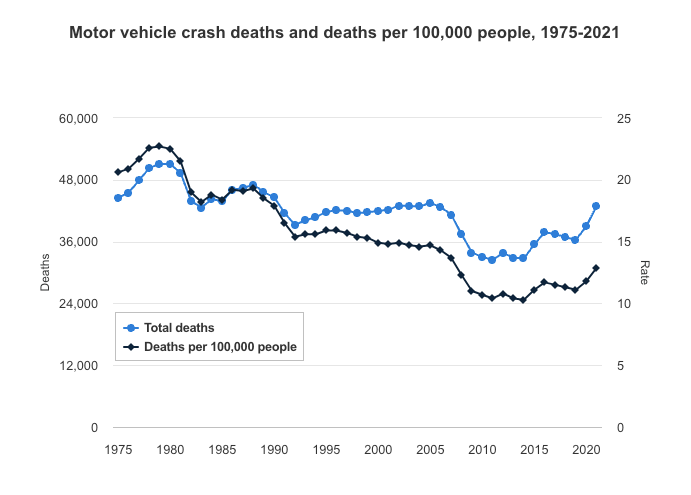

When we set our baseline for the Motor Vehicle Insurance CPI in the 1980s, people weren't wearing seatbelts, and drunk or buzzed driving wasn't much of a concern.

As communities and laws changed their positions on these things and vehicles became safer, we saw an almost steady decline in fatalities.

However, we also didn't have cell phones, which increased distracted driving. This is the primary reason we see an uptick in fatalities starting around 2018.

Insurance carriers use historical actuarial data to set rates, so they are now trying to hedge against that spike.

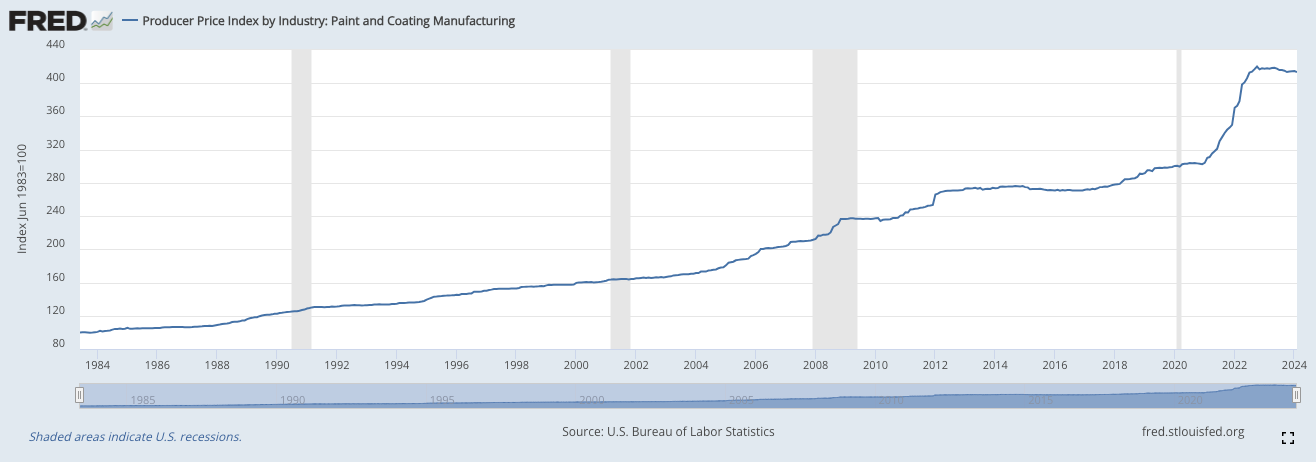

Cost of Repairs

The cost of repairs is increasing partly because inflation is pushing the costs of parts and labor up ($1 in 2019 is equal to $1.24 today). Here's the PPI for Paint and Coating Manufacturing:

Electric vehicles are also more expensive to repair, which might not apply directly to you, but they impact loss ratios overall.

What's ahead?

I'm taking solace in the decreasing value of used vehicles because if history rhymes, auto insurance rates will eventually fall. However, no one has a crystal ball on anything economic.

For now, practical decisions at the individual level matter. Be smart about what claims you file with your carrier, don't text and drive, don't scroll Instagram at the stop light, don't speed, and be a courteous driver.