The Basics of Carbon Capture

While we’re an insurance broker, we aim to understand our clients through more than just the risk lens. We take an engineering approach, which enables us to discuss field operations with our carriers and underwriters.

Companies like 1PointFive and San Joaquin Renewables have demonstrated early successes in decarbonization, and as legal and financial advisory gains clarity, more companies will begin scaling operations.

How do carbon credits work?

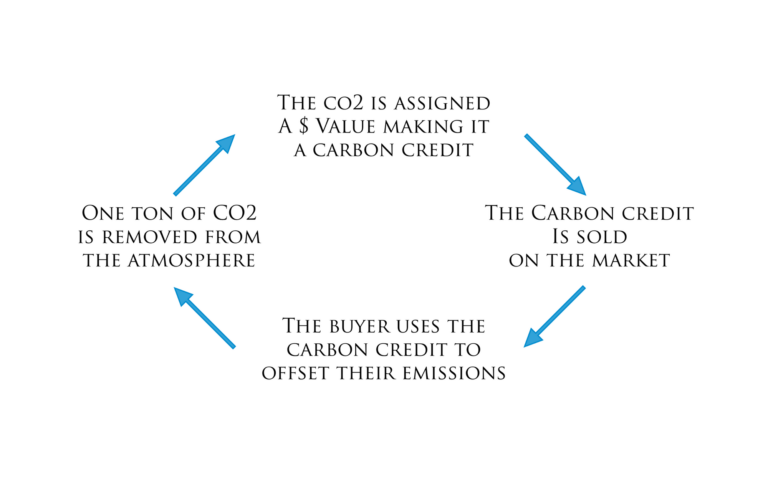

A carbon credit is a financial instrument used to incentivize activities to reduce carbon emissions.

Simply put, one ton of carbon removed or reduced from the atmosphere is assigned a financial value. The value is then utilized as a credit against other carbon-producing business activities.

Carbon credits can be bought and sold on carbon markets, either regulated or voluntary. Regulated carbon markets are established by governments, while voluntary carbon markets are not.

Once a carbon credit is applied, it has been “recognized” and cannot be reused.

There is a growing industry in accounting for these credits, and technology such as blockchain has been proposed for immediate auditing and accountability.

Two key carbon capture technologies

Carbon removal is the process of removing legacy emissions from the air. This can be done through land-based initiatives like restoring forests and grasslands. Carbon removal changes the natural chemistry entirely.

Carbon capture refers to technologies that separate Co2 from the atmosphere, then permanently store the molecule elsewhere.

Direct Air Capture (DAC)

Air passes through a fan and a chemical reaction selectively binds with carbon dioxide and separates it. The carbon dioxide is then liquified for storage. This technology allows for net zero and even net negative carbon.

Point Source Capture

Point source carbon capture involves capturing CO2 at its source before it is released into the atmosphere. The technology is similar to DAC, but it differs in that CO2 is gathered directly from a CO2 emitter.

Carbon Sequestration

Carbon sequestration is the storage of carbon dioxide so that it is prevented from reentering the atmosphere. This can be underground, offshore, or in even in biomass material. The CO2 can exist in a super critical liquid or gaseous state.

Measure and Manage

As companies purchase carbon credits, they will look to carbon capture operators to help fill the demand.

The estimated cost of carbon removal is $200-600/ton. Carbon removal will be scalable at $100/ton, with the goal being $50/ton.

Because the cost of carbon capture is high, investors are looking for ways to increase the value of carbon offsets:

KraneShares Global Carbon Strategy ETF ($KRBN) noted that the global price of carbon was $51.40 per ton of CO2 on March 31, 2023. It is estimated that carbon allowance prices need to reach $147 per ton of CO2 to meet the 1.5°C global warming limit outlined by the Paris Agreement.

Potential Benefits

- Sustaining fossil fuels: While transitioning to renewable energy sources is essential, fossil fuels continue to be a significant part of global energy.

- Industrial emissions reduction: Implementing point source capture into industrial processes can help reduce carbon emissions up front.

Pessimism sounds helpful, and optimism sounds like a sales pitch. – Morgan Housel

Potential Criticisms

- Unknown impacts of long-term storage: Compared to other storage methods, sequestration is a recently reintroduced application.

- It extends the fossil fuel era instead of ending it: Carbon capture may be viewed as a short-term solution against the goal of ending fossil fuel usage entirely.

Carbon capture is a form of taking action for a better future, and as technology progresses, operations and policies can adjust. The ultimate goal is environmental stewardship while providing affordable energy.