Insurance Insider Perspectives

Last month, I attended a risk management conference focused on the California insurance market.

Last month, I attended a risk management conference focused on the California insurance market.

Joel Laucher, former Chief Deputy Commissioner of CA, and Patrick Sullivan, Senior Editor of Risk Information Inc. shared their thoughts at the event.

Riveting stuff.

Pat made the writing easy and thoughtfully emailed me back. I've distilled my interpretation of what he shared below.

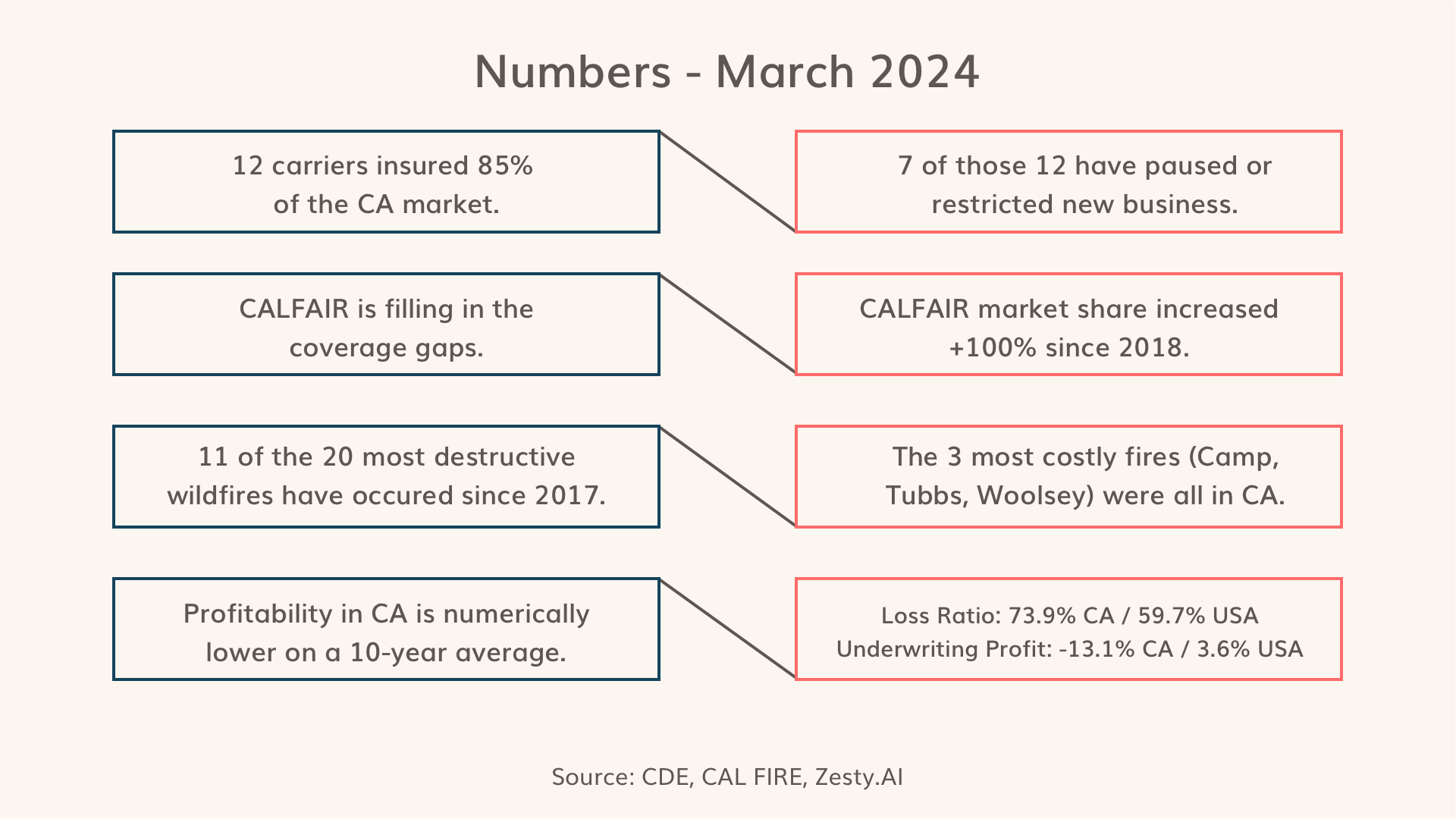

Numbers

Is the FAIR Plan holding up?

The California Department of Insurance (CDI) proposed regulations on February 9th, but I will let the lawyers do most of the reading there.

Since 2021, CFP has experienced a 16% annual growth in policy count and 33% growth in total insured value.

It is intended to be a carrier of last resort, covering risks that standard carriers don’t want at prices they don’t set. To do business in California, carriers have to participate in funding the program as a member company.

That means that as more people are forced onto the Fair Plan, so does the member company's exposure, even if they’ve stopped writing in the state. All that to say, insurance companies want a resolution as well.

The Premiums Barbell

Change needs to happen swiftly so the crisis does not widen. Consumers need insurance at reasonable rates, and carriers need fair regulatory guidelines.

Rate Filings

The Primary Concern

Insurance rate filings are documents that insurance companies must submit to the Department of Insurance before using rates to calculate premiums.

Prop 103 gives the CDI 60 days to review a new rate filing and 180 days to commence hearings, but the CDI has always forced carriers to waive these lines.

So how long are these home insurance rate filings taking across the three most challenged states? Per Milliman:

- California: 366 days

- Florida: 136 days

- Texas: 89 days

Why the delays?

This is a staffing and process issue, the remedy being to hire more staff and change the culture. Even with a rockstar recruiting team, that's a lot to tackle.

Rate approvals are getting through, though.

Here's a sample of rates that are approved or waiting in the wings:

- Auto Club +20%

- Allstate +40%

- AMICA +43%

- Farms Mid-Century +47%

- Grange +24%

- Safeco +11%

- State Farm +20%

- Travelers +22%

- USAA +30%

- Western Mutual +29%

Source: Rate Filings

Write Business & Bring Down Losses

One way to quickly alleviate the pressure is to encourage more business to be written outside the California FAIR Plan.

Simultaneously, the conversation needs to focus on how to bring down losses. As losses go down, availability and affordability go up.

For now, the CDI must allow some increase in premium without letting the whole structure collapse.